You will not be able to change the package after this!

Are you sure you want to unlock

You will not be able to change the package after this!

Are you sure you want to unlock

Are you ready to embark on an exciting journey in the dynamic world of the securities market? At MarketMentors.co.in, we are dedicated to shaping the next generation of financial professionals and providing them with the tools to thrive in the ever-evolving market landscape. Join us on a path of growth, learning, and unparalleled opportunities.

Expert Guidance: Benefit from mentorship by seasoned professionals with years of experience in the securities market.

Innovative Learning: Access cutting-edge resources, workshops, and training programs to stay ahead in your field.

Career Advancement: Enjoy a dynamic work environment that encourages continuous learning and provides avenues for professional growth.

Community Support: Join a community of like-minded individuals who share a passion for finance and securities. Collaborate, learn, and grow together.

Securities Analyst: Dive deep into market trends, conduct in-depth research, and provide valuable insights to guide investment decisions.

Financial Educator: Share your knowledge and passion for finance by educating and empowering others through engaging workshops and programs.

Trading Specialist: Execute strategic trades, analyze market data, and contribute to the success of our trading operations.

Mentorship Coordinator: Facilitate mentorship programs, connecting aspiring professionals with industry experts for guidance and support.

Market Strategist: Develop and implement innovative strategies to navigate the securities market, staying ahead of the curve.

Customer Relations Specialist: Foster strong relationships with our clients, providing support and guidance as they navigate their financial journeys.

The securities market offers a wide range of career opportunities for individuals interested in finance, investments, and capital markets. Here are some common careers in the securities market:

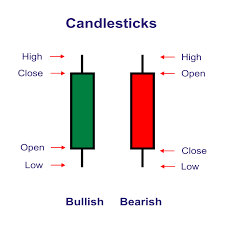

Candlestick patterns are a popular tool used in technical analysis to analyze price charts of financial instruments, such as stocks, currencies, commodities, and cryptocurrencies. These patterns provide insights into market sentiment and can help traders make informed decisions about potential price movements.

Here are some common candlestick patterns:

Doji : A Doji has the same opening and closing prices, or the difference between them is very small. It suggests market indecision and potential reversal.

Hammer and Hanging Man: Hammer and Hanging Man patterns have a small body and a long lower shadow. Hammer occurs in a downtrend and suggests potential reversal to the upside. Hanging Man occurs in an uptrend and may signal a potential reversal to the downside.

Shooting Star and Inverted Hammer: Shooting Star and Inverted Hammer patterns have a small body and a long upper shadow. Shooting Star occurs in an uptrend and suggests a potential reversal to the downside. Inverted Hammer occurs in a downtrend and may signal a potential reversal to the upside.

Bullish and Bearish Engulfing: Bullish Engulfing pattern occurs when a small bearish candle is followed by a larger bullish candle, completely engulfing the previous one. Bearish Engulfing is the opposite, signaling potential downside reversal.

Morning Star and Evening Star: Morning Star is a bullish reversal pattern consisting of three candles: a long bearish candle, followed by a small bearish or bullish candle, and then a long bullish candle. Evening Star is the bearish counterpart.

Three White Soldiers and Three Black Crows: Three White Soldiers is a bullish reversal pattern characterized by three consecutive long bullish candles. Three Black Crows is the bearish equivalent.

Double Top and Double Bottom: Double Top is a bearish reversal pattern formed after an uptrend, indicating a potential reversal to the downside. Double Bottom is a bullish reversal pattern formed after a downtrend, signaling a potential reversal to the upside.

Head and Shoulders: Head and Shoulders is a trend reversal pattern that consists of three peaks: a higher peak (head) between two lower peaks (shoulders). Inverse Head and Shoulders is the bullish counterpart.

It's important to note that while candlestick patterns can be useful, they should not be used in isolation. Traders often use them in conjunction with other technical analysis tools and indicators for more robust decision-making. Additionally, market conditions and overall trends should be considered when interpreting candlestick patterns.

Tailored Curriculum: Seek out mentors or platforms that offer personalized learning paths based on your current knowledge level, goals, and interests in the stock market.

Experienced Mentors: Look for mentors or educators with a solid track record in the stock market, preferably with years of experience in trading or investing. They should have a deep understanding of various strategies and market dynamics.

Interactive Learning: Choose a program that offers interactive sessions, live trading demonstrations, and opportunities for Q&A sessions with mentors. This interactive approach can enhance your learning experience and help clarify any doubts you may have.

Real-World Case Studies: Learning from real-world examples and case studies can provide valuable insights into how market principles are applied in practice. Look for educational materials that include such case studies to deepen your understanding.

Continuous Support: Ensure that the mentorship or educational program offers ongoing support and guidance, even after the formal training sessions have ended. This might include access to a community forum, regular updates on market trends, or additional resources for further learning.

Practical Experience: Hands-on experience is crucial for gaining confidence and proficiency in stock market trading or investing. Seek out programs that offer simulated trading environments or opportunities to execute real trades under guidance.

Feedback and Evaluation: A good mentor or educational program should provide constructive feedback on your progress and performance, helping you identify areas for improvement and refining your skills over time.